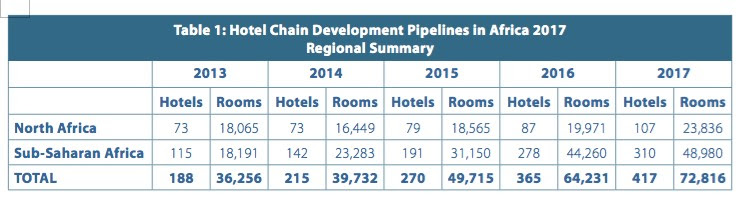

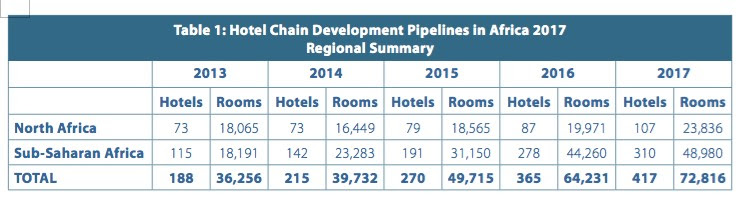

Hotel development activity in Africa is still rising in the face of the continent’s economic problems, showing a 13 per cent increase in 2017, according to the annual survey by W Hospitality Group, generally acknowledged as the most authoritative source on the sector’s growth.

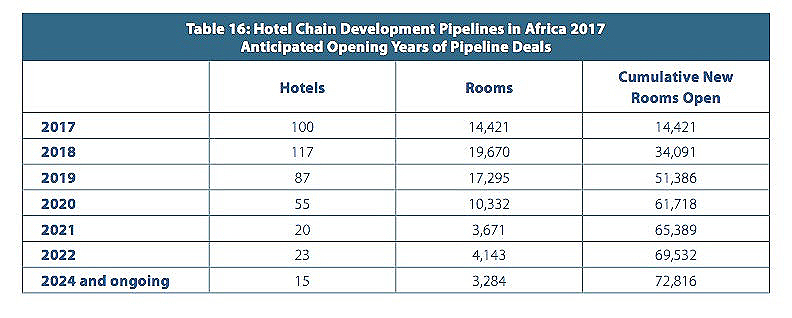

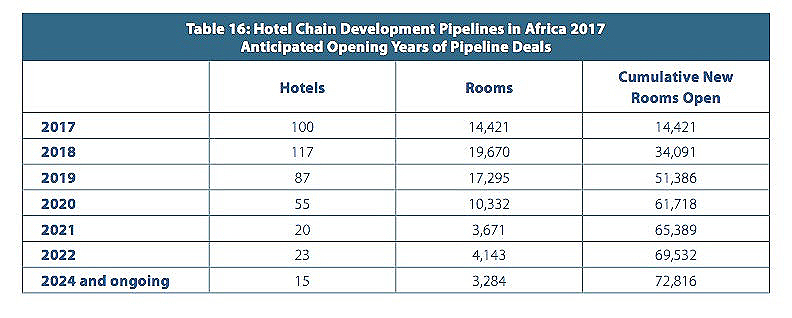

The ninth edition of its Hotel Chain Development Pipelines in Africa has 36 international and regional contributors reporting almost 73,000 rooms in 417 hotels. The figures have grown each year, more than doubling since 2009.

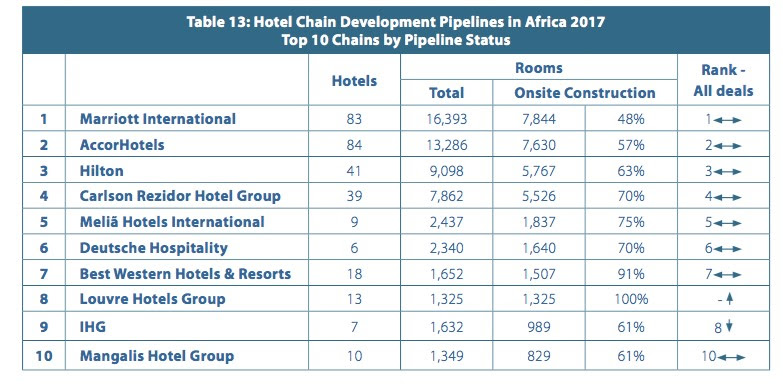

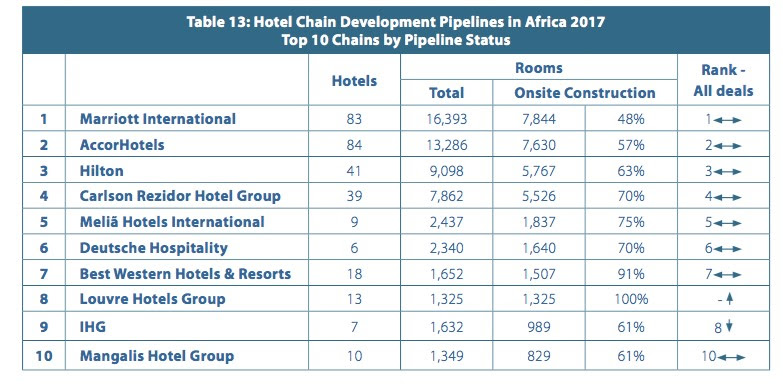

This year, bragging rights are shared; Marriott International, boosted by its merger with Starwood, comes top of the table in terms of number of rooms planned. But AccorHotels continues to lead – just – by the number of hotels in its pipeline. By country, Egypt is in first place with the highest number of hotel rooms in the on-site construction phase.

The report, along with all the challenges of developing new hotels in Africa will be discussed by industry leaders and government officials at the seventh Africa Hotel Investment Forum (AHIF) in Kigali, in October. AHIF is the highest-level gathering of hotel investors and developers in Africa.

Many African countries faced a challenging 2016, with lower prices for oil and other commodities, devalued currencies and other negative factors. That may have affected confidence in the short-term, as the number of deals signed was 86, down from 121 in 2015.

Despite the slowdown, some countries benefited from cheaper oil imports and there was increased activity in southern and east Africa. In addition, more hotel chains established development offices on the continent, to address the fact that Africa is still massively under-provided with rooms.

Growth is expected to be more muted in 2017, and financing and bureaucratic hurdles remain, but an increasing number of deals are coming to fruition on time: from only 26 per cent opening their doors on schedule in 2014, to 47 per cent in 2016.

Some key findings:

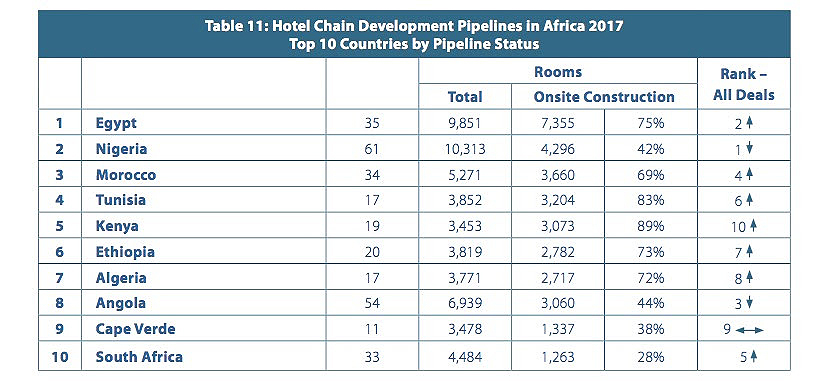

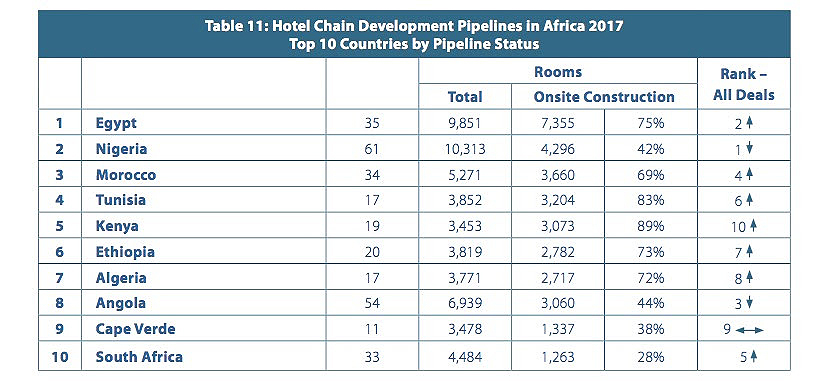

The results show that investor confidence is returning to North Africa after several years of turmoil and uncertainty in countries such as Egypt and Tunisia.

The results show that investor confidence is returning to North Africa after several years of turmoil and uncertainty in countries such as Egypt and Tunisia.

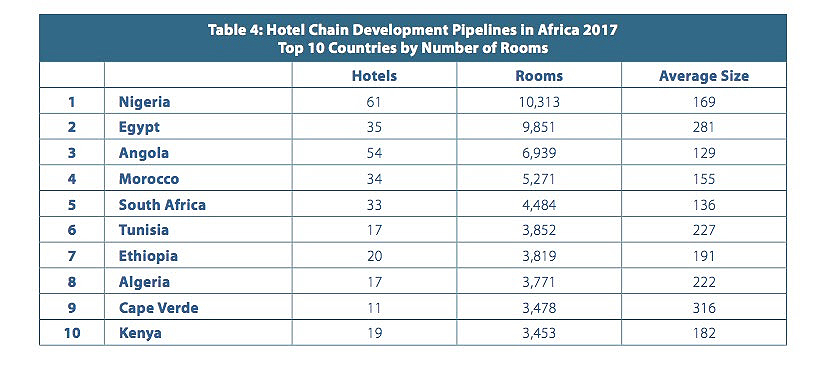

The top ten contains four of the five North African countries, with several deals signed in 2016, including 12 in Egypt.

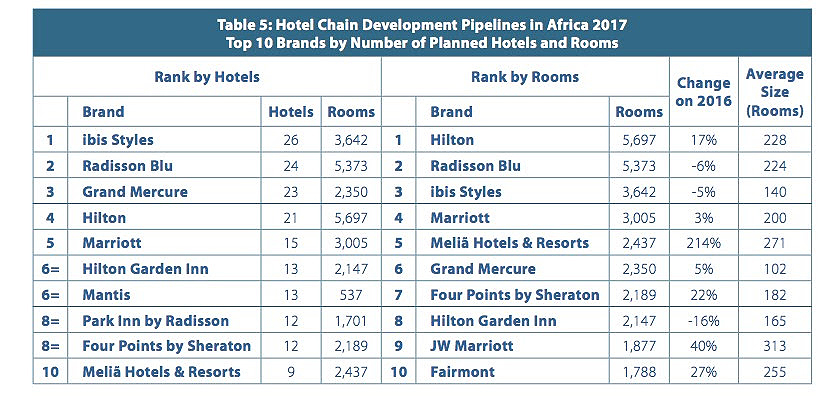

In the ranking by number of hotels, AccorHotels has two brands in the top five positions – Ibis Styles and Grand Mercure, both pipelines primarily in Angola. When ranked by the number of rooms, the Hilton brand displaces Radisson Blu from last year’s top slot.

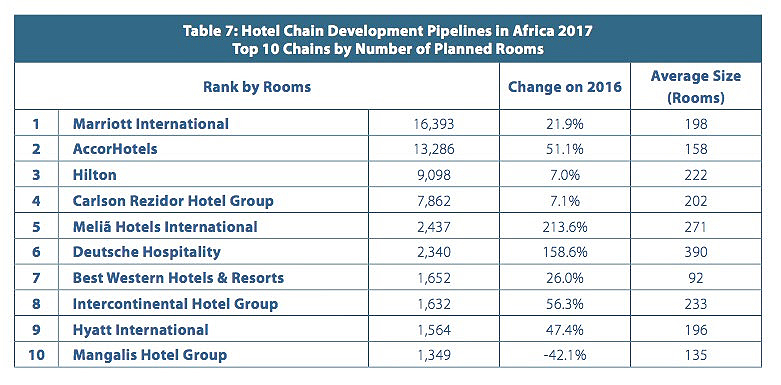

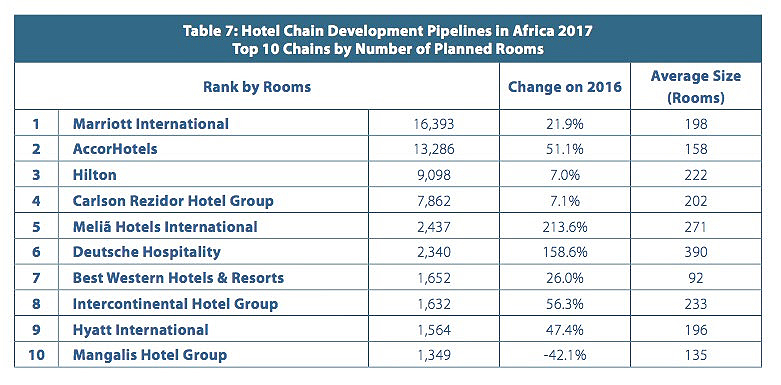

AccorHotels continues to lead the ranking of the chains – as opposed to individual brands - by number of planned hotels, 84 vs 83.

But Marriott International leads in terms of rooms, 16,393 vs 13,286.

Nigeria has the most hotels and rooms in the development pipeline, but Egypt has the most rooms actually under construction, almost 75% of the total.

Marriott, AccorHotels, Hilton and Carlson Rezidor Group retain their position as the top four hotel chains by pipeline status.

Based on the hotel deals signed by the chains at the time of the survey, their anticipated opening years are shown in the table below. A hundred new hotels are expected to open their doors this year and 117 next year, although expectations are often over-optimistic, as noted above!

W Hospitality Group managing director, Trevor Ward, said: “Several countries in Africa have suffered severe economic problems in the past couple of years.

“But there are encouraging signs that we are turning a corner in 2017, and whilst growth is more muted, there is definitely an acceptance of the “new normal”, with a desire to move forward again in a climate of lower-valued currencies, less government spending and lower GDP growth.

“The world in 2017 is a very different place to when we started this survey in 2009. But Africa is still rising, at least as far as the development activities of the hotel chains is concerned. Whilst the chains do not, generally, build or invest in the hotels they brand, at the other side of every deal there is an investor eager to do so.”

Matthew Weihs, managing director of Bench Events, concluded: “With many more rooms in the pipeline and a much higher proportion being built on time, one has to recognise that hotel development in Africa is becoming an increasingly serious business.”